Indiana Senate Bill 35 aims to require Indiana high school students to learn about personal financial literacy before graduation, which would teach students about loans, debts, savings, etc. past 2028. But, how would this affect South students?

Melissa Williams teaches the course Personal Finance, and it is already a very similar course to what is being mandated by the state. The course includes one trimester of content, though Williams notes that it is “hard to get through everything students should know,” making it subject to change in the future.

One important detail is that the course would change from being an elective into a required course — similar to health or gym — forcing students to add yet another course to their already tight class schedule.

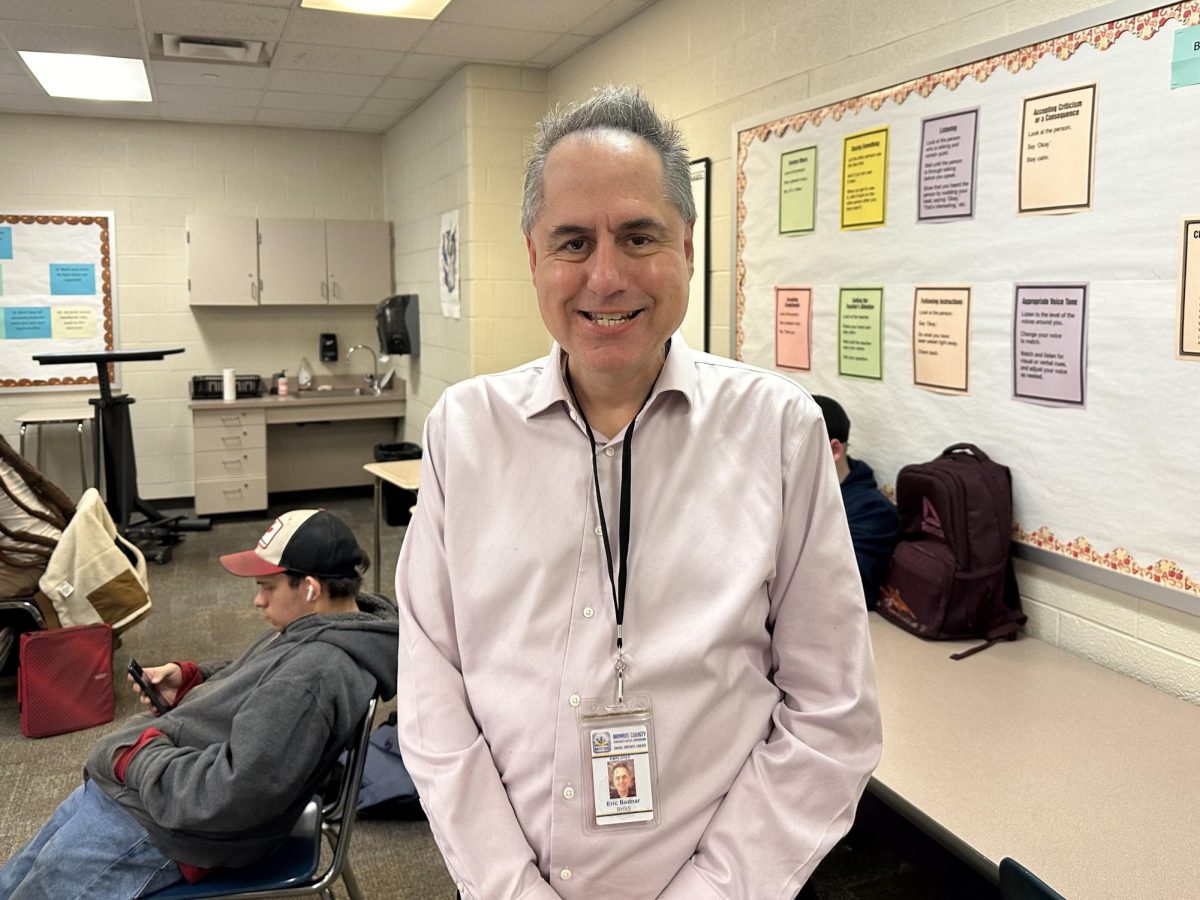

Teacher Jeana Kerr noted that making the course required adds more strain to the school faculty. Considering the large number of South students per grade, it is not possible for one teacher to cover every student. Kerr warns that without cooperation from the state of Indiana, it would be “hard on the school corporation to fund [the teacher].”

Both Kerr and Williams said the class’s change from elective to mandatory was a welcome change. Both said that the practicality of the class was important, since every student will eventually depend on their own money.

As of now, there are no specifics on either the length of the class nor the type of qualifications that would be required for teaching the class. Plus, the description of the required topics so far is pretty general: there’s nothing about the nuanced or riskier aspects of personal finance, like cryptocurrencies or the stock market.